Optimizing Tax Benefits for Buyers and Sellers During the Sale of a Business: F-Reorganization Structures

Different transaction structures provide various tax benefits and pitfalls to buyers and sellers of businesses that may cause conflict among the parties, but a well-planned reorganization prior to a transaction can, in some cases, provide desired tax benefits to both sides of the transaction. Typically, sellers prefer the sale of equity while buyers prefer the purchase of assets. Fortunately, there are transaction structures that allow the purchase of a target’s equity to be treated as a purchase of assets for tax purposes. One such option stems from Section 368(a)(1)(F) of the Internal Revenue Code which provides a type of tax-free reorganization of a target, for potential buyers and sellers to then take advantage of when structuring the sale of a business. Commonly known as an F-type reorganization structure (or F-reorg), such method is commonly used as an M&A strategy whereby the parties structure a pre-transaction reorganization of a target to cause the equity acquisition of such target to be deemed a purchase and sale of assets for tax purposes.

The Importance of an F-Reorganization

Buyers typically prefer to acquire the assets of a target over equity because a buyer receives a step-up in tax basis for the acquired assets. The effect of a step-up in tax basis is “stepping up” the tax basis of assets to their fair market value upon the consummation of a proposed transaction. Post-closing, a buyer can then take tax deductions on future taxable income via the depreciation or amortization of the acquired assets. An F-reorganization structure allows a buyer to take advantage of the same step-up in tax basis for the assets of a target despite acquiring equity. Without the F-reorganization structure, assets in a straight equity purchase would simply carry over their tax basis (following the equity acquisition of the target), potentially minimizing the value of the transaction for a buyer.

What is an F-Reorganization

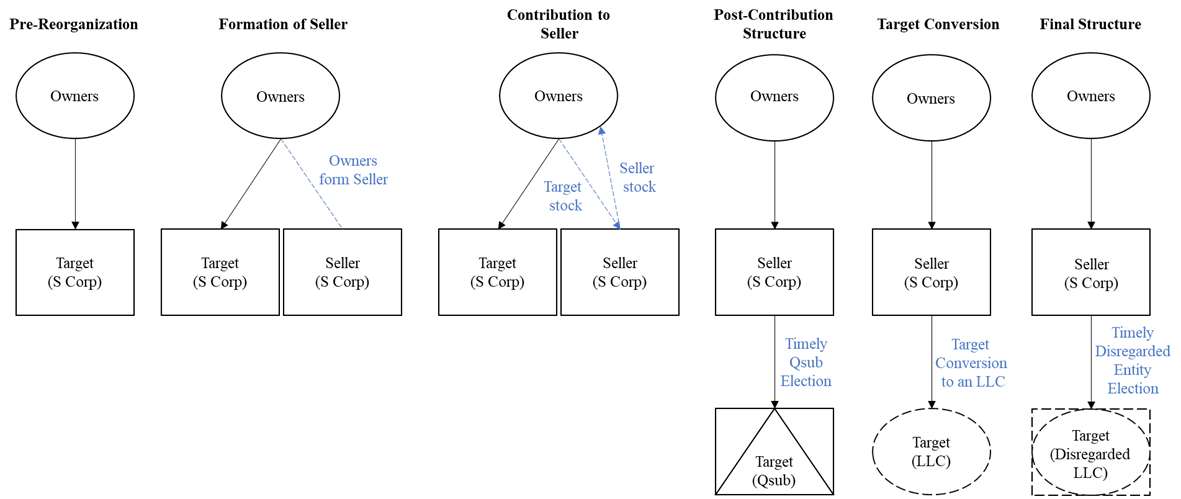

An F-reorganization presumes that the surviving corporation is the same corporation as the predecessor in every respect, except for minor or technical differences. Under Section 368(a)(1)(F) of the Internal Revenue Code, an F-reorganization is a corporate reorganization by virtue of “a mere change in identify, form or place of organization, however effected.” An F-reorganization in the context of an M&A transaction typically consists of the following five (5) steps:

-

The owners of the target, an S-corporation, form a new S-corporation (which acts as the seller in a proposed transaction).

-

The owners of the target contribute all of their shares of stock in the target to the seller in exchange for equity in the seller (ownership percentages are typically identical to the ownership percentages held by each owner in the target prior to the F-reorganization).

-

Following the contribution by the owners, the target becomes an S-corporation subsidiary of the seller. The target and seller file a timely Qsub election with the IRS to treat the target as a Qsub of the seller (a Qsub is an S-corporation subsidiary of an S-corporation).

-

The seller, as the parent of the target entity, causes the target to convert from an S-corporation to a limited liability company (an LLC).

-

At least one day after the conversion, the target files a timely election with the IRS to be treated as a disregarded entity for tax purposes.

Upon completion of the F-reorganization, the owners hold all the equity interests of the seller, an S-corporation, with the target entity as its 100% owned subsidiary, a disregarded LLC. Buyers can then acquire the membership interests/units of the target entity from the seller with the purchase price flowing through to the owners. The acquisition of the target’s membership interest/units is deemed a sale and purchase of assets for tax purposes. It is important to highlight that the foregoing steps require careful planning and execution as an improper reorganization may not qualify as an F-reorganization under Section 368 of the Internal Revenue Code. More importantly, improper execution of an F-reorganization will deprive the parties of the desired tax benefits and transaction structure contemplated by the pre-transaction reorganization.

Potential Benefits and Pitfalls of F-Reorganizations

Potential benefits include the following:

- An F-reorganization provides parties with some additional flexibility and protection in a transaction structure, than alternatives such as a tax election under Section 338(h)(10) of the Internal Revenue Code. Under the latter, both parties must make the 338(h)(10) election which causes some risk to a buyer if the seller does not make the proper election correctly. Similarly, a 338(h)(10) election requires the target to maintain its S-corp election which causes the buyer to assume the potential risk the S-corp election is invalid or was lost. An additional consideration is that under 338(h)(10), an equity rollover is limited to a maximum of 20% of the target’s pre-transaction equity.

- Although an F-reorganization adds additional complexity and costs for a seller, it tends to save time and costs during the transaction.

- For example, an F-reorganization could minimize the number of third-party consents or notices that may be required prior to the consummation of a proposed transaction.

- Sellers may be able to leverage an F-reorganization for a higher purchase price given a buyer’s tax benefit from the transaction structure.

- An F-reorganization structure allows the favorable capital gains tax rates to be applied to the seller’s sale of equity in the target, ensuring sellers receive the tax benefits of an equity sale.

Potential pitfalls or items of consideration for parties include the following:

- Quantifying a buyer’s step-up in tax basis benefit by taking the present value of the post-closing tax deductions a buyer expects to take can be a complicated process.

- Buyers should consult with an accountant when calculating such value.

- Buyers should consider whether there will be sufficient post-closing taxable income to absorb the tax deductions from the step-up in tax basis.

- Parties will likely have competing views on the purchase price allocation which has various tax effects on both parties.

- Sellers should consult with an accountant regarding the risk of recaptured depreciation that may be treated as ordinary income due to the step-up in tax basis from an F-reorganization.

- Buyers should be aware that, although the potential transaction will be treated as an acquisition of assets for tax purposes when qualifying as a deemed sale and purchase of an LLC’s assets, buyers are still acquiring the equity of a target.

- Consequently, subject to the terms of the purchase agreement, buyers will likely inherit some or all of the liabilities of a target upon consummation of the transaction.

- Parties should consult with their legal counsel regarding the possible effects an F-reorganization may have on governmental filings, contracts, licenses, and other legal or business matters which may impact the timeline of a potential transaction.

Conclusion

An F-reorganization can be an efficient M&A strategy to maximize the value of the equity acquisition of a target. When planned carefully and executed correctly by professionals, a transaction structure that incorporates an F-reorganization can allow sellers to enjoy the simplicity and tax benefits of an equity sale of a business while buyers take advantage of the step-up in tax basis benefit typically achieved through an asset acquisition. Planning, beginning, and executing a potential F-reorganization and structuring an equity transaction as the sale of assets for tax purposes can be a complicated process. Navigating this process with the help of experienced professionals can be worthwhile if the benefits of an F-reorganization, notwithstanding the limitations, are right for your potential transaction.